are inherited annuity payments taxable

If the owner dies before the total investment in the contract is recovered and annuity payments cease as a result of his death the un-recovered amount is allowed as a deduction to the owner in. Minimum Guarantee Value is also known as.

Non Qualified Annuity Beneficiary Distribution Tax Options How To Protect Your Investment And Loved Ones Howard Kaye Insurance Agency Llc

The earnings on an inherited annuity are taxable.

. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death. The amount of tax withheld from an annuity or a similar periodic payment is based on your marital status and the number of withholding allowances you claim on your Form W-4P. B In addition to the exemption prescribed by Section 42001 and except as provided by this section a persons interest in and right to receive payments from a qualified savings plan whether vested or not is exempt from.

If you are receiving periodic payments payments made in installments at regular intervals over a period of more than 1 year use Form W-4P to have tax withheld from your IRA. A settlement typically includes a one-time lump sum of cash followed by regular payments. Vasyl wont include in his installment sale income any principal payments he receives on the installment obligation for 2022 2023 and 2024 because hes already reported the total payments of 500000 from the first disposition 100000 in 2020 and 400000 in 2021.

12 an annuity or similar contract purchased with assets distributed from a plan or account described by this subsection. Tax-Sheltered Annuity TSA Tax-sheltered annuities or TSAs to the IRS are pensions for employees of nonprofit organizations as specified by law in regards to Sections 501c3 and 403b of the Internal Revenue Code. The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill.

While bond income is taxable. In the long term annuities typically show better rates of return than bonds and. A variable annuity is a type of annuitya financial product that allows an individual to invest money in either a lump-sum payment or scheduled periodic paymentsand then collect a stream of.

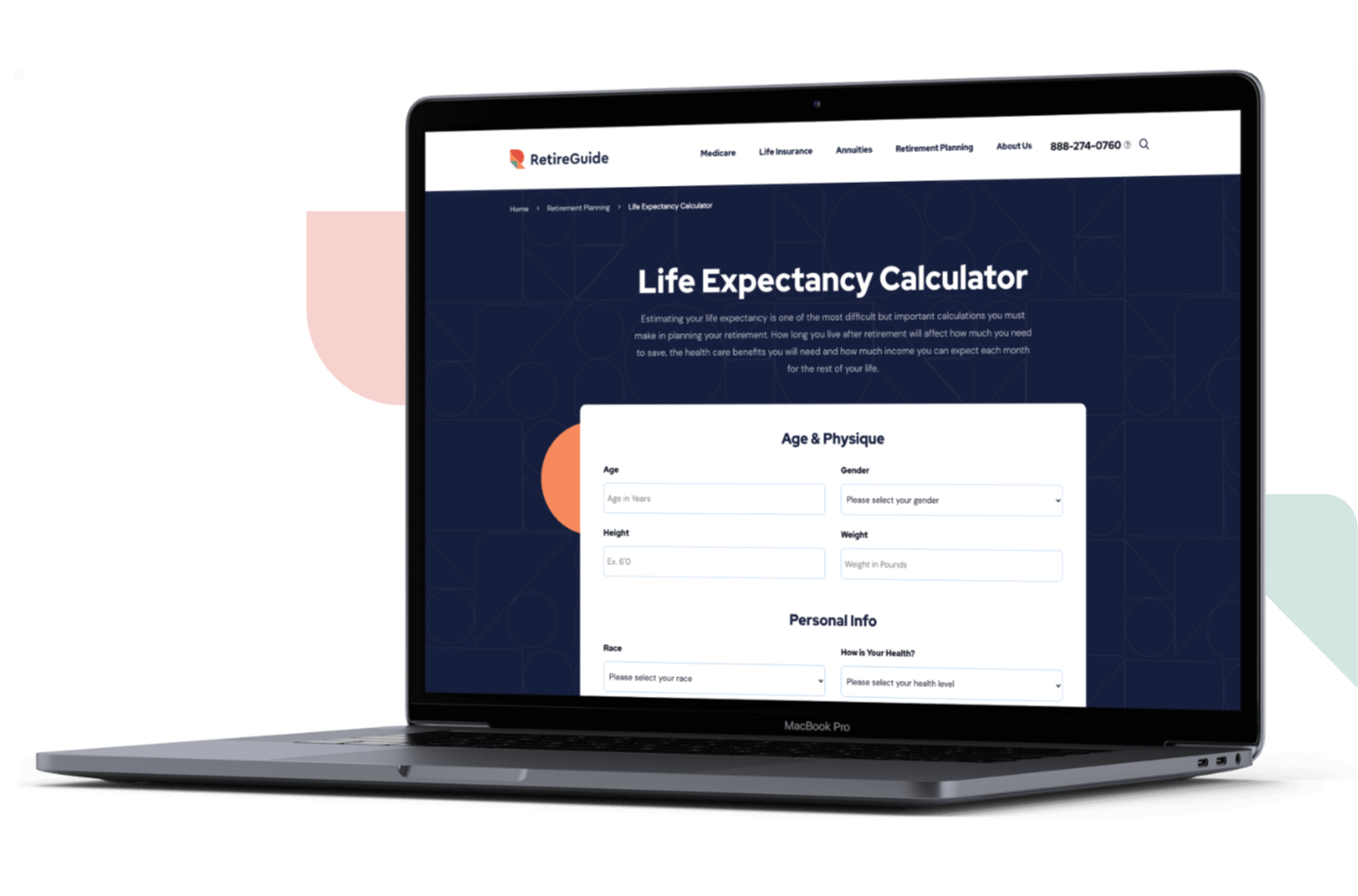

An annuity distributes these payments. How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or someone else. As of 2020 you can place up to 19500 per year into your retirement account.

The type of annuity you purchase determines your future annuity payments. The beneficiary receives the death benefit or any remaining annuity payments upon the death of the owner. The Minimum Guarantee Value in fixed index annuities is the minimum amount your money is worth guaranteed at any given time.

The Minimum Guarantee Value is a value to protect your retirement savings in times of a long market downturn similar to that of the Great Depression. SPIAs are also beneficial for younger people who have inherited a large sum of money and wish to protect the windfall from poor financial management. The annuity payments are fully taxable.

/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Is A Survivor Annuity Death Benefit Taxable Safemoney Com

How Does Inheriting An Annuity Work Smartasset

How To Avoid Paying Taxes On Annuities Due

Leaving Nonqualified Annuity For Child Will She Owe Tax

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Fixed Annuities And Taxes Match With A Local Agent Trusted Choice

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Taxation How Are Annuities Taxed

Inherited Annuity Tax Guide For Beneficiaries

Annuities And Taxes Annuity Tax Benefits And Strategies

![]()

Inherited Annuity Tax Guide For Beneficiaries

Is Annuity Inheritance Taxable