capital gains tax increase canada

They have increased the Lifetime Capital Gains Exemption Limit LCGE For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 883384. A capital gains tax increase would be a form of annual wealth tax that would be.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

When you gain profit from the sale of investments such as stocks bonds debt land or buildings you have made capital gains.

. Lifetime capital gains exemption limit. While history doesnt always repeat. If this were to happen the benefit of earning capital gains instead of income would be reduced.

For more information see What is the capital gains deduction limit. In Canada 50 of the value of any capital gains are taxable. Capital Gains Tax Rate.

For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to refer to capital gains as. In Canada the capital gains inclusion rate is 50. More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000.

Nearly every day Im asked to speculate about whether the capital gains inclusion rate currently set at 50 per cent could be increased to 75 per cent or some other. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office.

There has been some desire from federal parties to increase the capital gains inclusion rate to 75 or higher. Capital gains tax. Guidance on affidavits and valuations Bill C-208.

The capital gains inclusion rate refers to how much of a capital gain is taxable. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years. By Amir Barnea Contributing Columnist Sat.

Our recent study found that Canada ranks 22 nd out of 36 industrialized countries for our capital gains tax rate which at 27 is higher than key competitors including the United States 20 and. Photo by Brent LewinBloomberg files. Canadians pay a 50 tax on all of their capital gains.

He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. With Ottawas huge deficit due to the pandemic there is no better time to increase the capital gains tax inclusion rate to 75 writes Amir Barnea. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

When the tax was first introduced to Canada the inclusion rate was 50. Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

So here are a few pointers about taxes on. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues. In 1990 for instance the Conservative government raised the capital gains tax to 75 with the Liberal government returning it to 50 in the years after.

For Ontario clients in the top tax bracket Stienstra notes a 6667 inclusion rate would increase the tax rate on capital gains from 2677. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. It was then increased to 6667 per cent in 1988 and then to a high of 75 per.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. NDPs proto-platform calls for levying. Canadas top capital gains tax rate 27 per cent is currently above the average for countries in the Organization of Economic Co-operation and Development.

Drafter123 iStockphoto. In all Canadians realized 729 billion in taxable capital gains. Tax on capital gain 5353 b 10706 16059 0 0 Tax savings from 5041 donation tax credit c 25205 25205 25205 25205 Total cost of donation a b c 35501 40854 24795 24795.

After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on. For the past 20 years capital gains in Canada have been 50 taxable. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

Of the total 546 percent was declared by taxpayers with incomes over 250000. The party released the PBOs costing of its campaign platform on Saturday. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

How Much Tax Will I Pay If I Flip A House New Silver

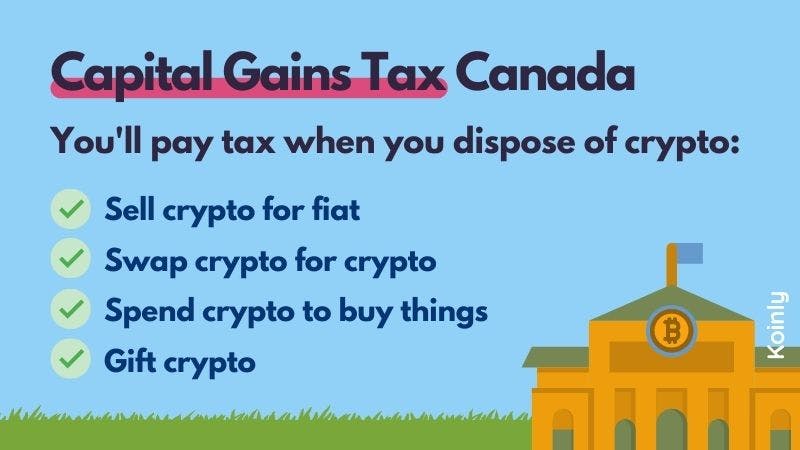

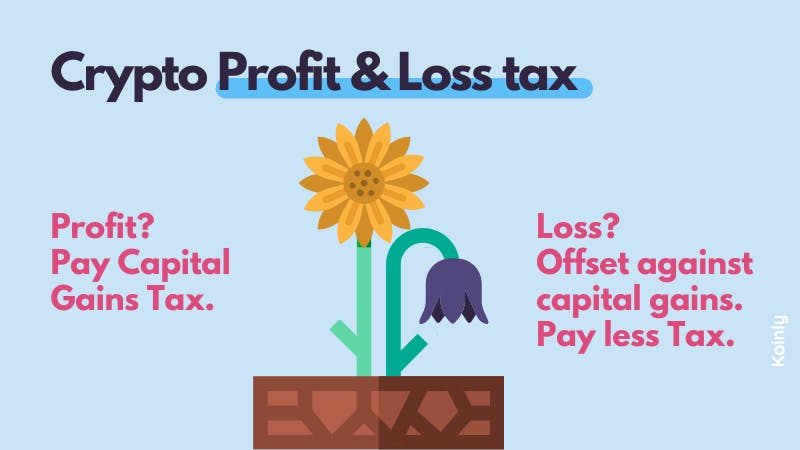

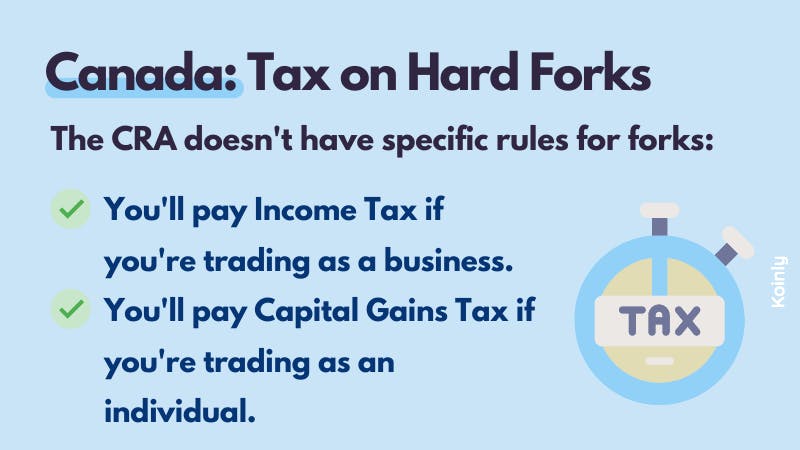

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada Explained

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

Difference Between Income Tax And Capital Gains Tax Difference Between

How Tax Rates In Canada Changed In 2022 Loans Canada

Moose Mountain Hike Near Bragg Creek Alberta Hike Bike Travel Mountain Hiking Bike Trips Hiking

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Capital Gains Tax In Canada Explained

Capital Gains Tax What Is It When Do You Pay It

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax What It Is How It Works Seeking Alpha

Capital Gains Yield Cgy Formula Calculation Example And Guide