does wyoming have sales tax on cars

In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and plate fees. Sales tax for vehicle is 5 of 20000 which 1000.

Get Trucking Authorities And Permits In Canada Usa Truck Stamps Trucking Companies Trucking Business

When you fill up your car with gas or buy a bag of groceries in Wyoming you will not pay any state tax on.

. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. With regards to financing a vehicle depending on the. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

If you are legally able to avoid paying sales tax for a car it will save you some money. Use tax applies where the purchase occurred outside of Wyoming and is for the use storage or consumption of the vehicle within Wyoming. This is a one-time fee levied when you first register a vehicle after a purchase.

Some have no sales tax while some states have high sales tax rates above 10. You pay Natrona County Wyoming sales tax at 5. The state sales tax rate in Wyoming is 4 and there are some places in the state where that is the only rate that applies.

There are some other loopholes too. Sales tax applies where the purchase of the vehicle occurred in Wyoming. What States Have No Sales Tax on RVs.

Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. Have a question or comment. Counties are able to add their own local sales tax to this state rate however and this can come in the form of an economic development county option tax a general purpose county option tax or a.

4 13 - Wyoming Sales Tax Exemption Certificate. You can find these fees further down on the page. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

When buying a vehicle youll generally need to factor in the following costsfees in addition to the purchase price and tax. If you purchase a used Honda Civic for 10000 you will have to pay an. How many years the vehicle has been registered for use then multiplied by 003.

However the state has an effective vehicle tax rate of 26 according to a. However if you buy a vehicle in one of those states you will likely have to. What is Wyomings Sales and Use Tax.

This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. NO INHERITANCE OR ESTATE TAX. Sales and Use Tax The county treasurer collects a sales or use tax on all vehicle purchases.

A sales or use tax is due prior to first registration of. The year of service rate is calculated like the following. Sales tax applies where the purchase of the vehicle occurred in Wyoming.

For example vehicles manufactured more than 40 years before January 1 of the year is automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are also. The minimum sales tax varies from state to state. If for some reason you are unable to obtain the title to your vehicle within the 50 days you can avoid penalties and interest by paying the sales tax.

When buying cars in Florida Alabama residents pay only 2 Colorado residents pay 29 Hawaii and Wyoming residents pay 4 and Louisiana residents pay 5 sales tax. Providing a completed bill of sale is also important. Wyoming repealed its estate tax as of January 1 2005.

Have all the sellers listed on the. Wyoming real estate sales are not taxed. Wyoming Sales Tax Rates.

An example of taxed services would be one which sells repairs alters or improves tangible physical property. NO TAX ON THE SALE OF REAL ESTATE. See the publications section for more information.

Buying From an Individual. A few things you will need to make sure you receive from the seller or take care of in order to title and register the vehicle in Wyoming. The states with the lowest combined state and local sales tax rates are Hawaii Wyoming Wisconsin and Maine.

For example if you purchased a vehicle from Montana which has no sales tax but you live in Natrona County Wyoming. Wyomings sales tax rates for commonly exempted items are as follows. 6 percent What States Have Sales Tax Rates That Exceed 10 Percent.

There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon. That way you dont have to pay a sales tax on the vehicle in the new state when you re-register it. Do Wyoming vehicle taxes.

Use tax applies where the purchase occurred outside of Wyoming and is for the use storage or consumption of the vehicle within Wyoming. This figure is a little more complex. The WY sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

The dealer will also collect sales tax from you. State wide sales tax is 4. It is determined by vehicle FACTORY COST found on title and vehicle years of service ie.

Wyoming DMV registration fees. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

Wyoming does not assess any state inheritance tax. If you live in a state with a sales tax rate higher than Florida such as New Jersey California and Tennessee Florida gives you a partial exemption. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates.

Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. Wyoming does not require smog or emissions testing. The amount you pay in sales tax will depend on where the car is registered not where it was purchased.

The tax fee is based on your countys tax rate. Purchase a used truck in Wyoming you will still pay Wyoming sales tax. Registration Fees County Fee.

For example sales tax in California is 725. Classic cars have a rolling tax exemption. The rate is also determined by the local municipalities so it varies from one area to another according to the state.

Some states charge more than a 10 percent sales tax on car purchases. Wyoming does not. Payment of Sales Tax on Motor Vehicles Sales tax on motor vehicles is due within 65 days of the date of purchase or penalties and interest will be assessed by the County Treasurer.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. Are services subject to sales tax in Wyoming.

If You Re Shopping For A Used Car Make Sure You Buy It In Wyoming

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Lemonchecks Com On Twitter Oil Change How To Apply Car Care

Wyoming License Plate Wyoming Fast Cars Teddy Bear Picnic Song

Sales Tax On Cars And Vehicles In Wyoming

If You Re Shopping For A Used Car Make Sure You Buy It In Wyoming

2021 Kia Seltos Kia Small Suv New Suv

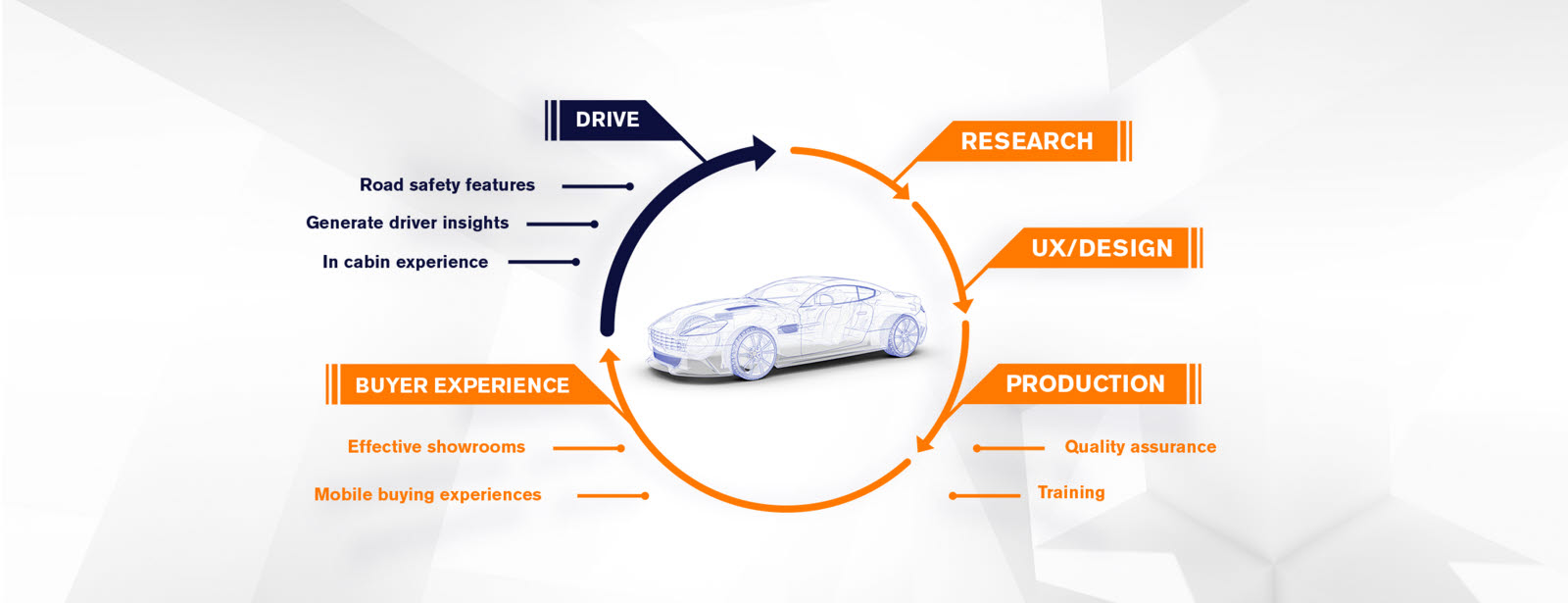

Eye Tracking Solutions For The Vehicle Lifecycle Tobii

Five Highlights From The Frankfurt Auto Show The Economic Times Auto Frankfurt New Cars

Fit For The Queen Rolls Royce Unveils Its First Ever 4x4 Rolls Royce Classic Cars Best Classic Cars

What Does A Vehicle History Report Tell You Communityblog History Vehicles Car Mechanic

Dixie Flyer Flyer Dixie Car Ads

Lambo Huracan Wallpapers Top Free Lambo Huracan Backgrounds Wallpaperaccess Lamborghini Huracan Lamborghini Lambo Huracan

Nj Car Sales Tax Everything You Need To Know

1976 Fiat Advertising Road Track April 1976 Fiat Old Ads Fiat 128

New Pink Tax Study Shows Women Pay Upwards Of 7 800 More For Car Ownership